—

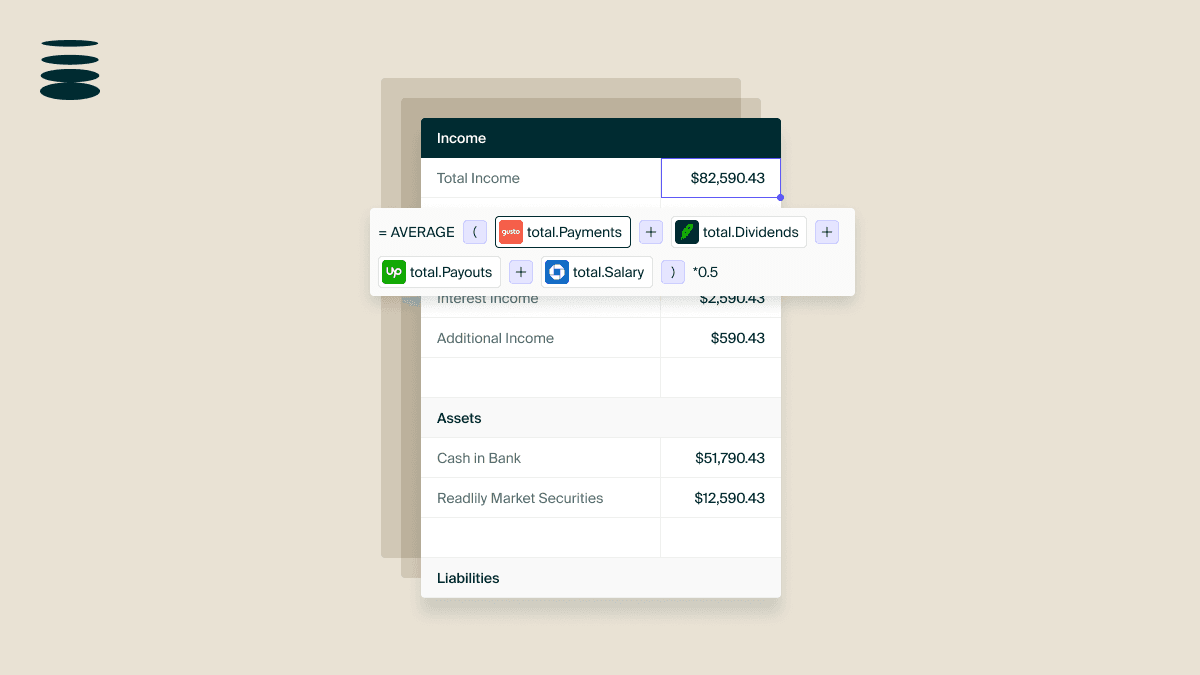

the components of a credit application that allow an applicant to connect personal accounts directly to their application. This gives a lender read-only access to real time data so that they can make more well rounded, accurate decisions faster with more reliable data.

Opting in to connect accounts enables lenders to make more accurate credit decisions much faster than with a traditional application. Borrowers often find that this improves their experience in the form of faster applications, more efficient decisions, and even competitive pricing.

Account integrations can range from bank accounts and accounting software to client relationship management systems, vendor contracts, and even social media accounts that highlight positive marketing growth.

SOLO enables 4,000+ account integrations within credit applications.

Learn how to leverage account integrations in financing applications with our Master Class, led by Rob Frohwein, the Co-Founder and longtime CEO of Kabbage: