—

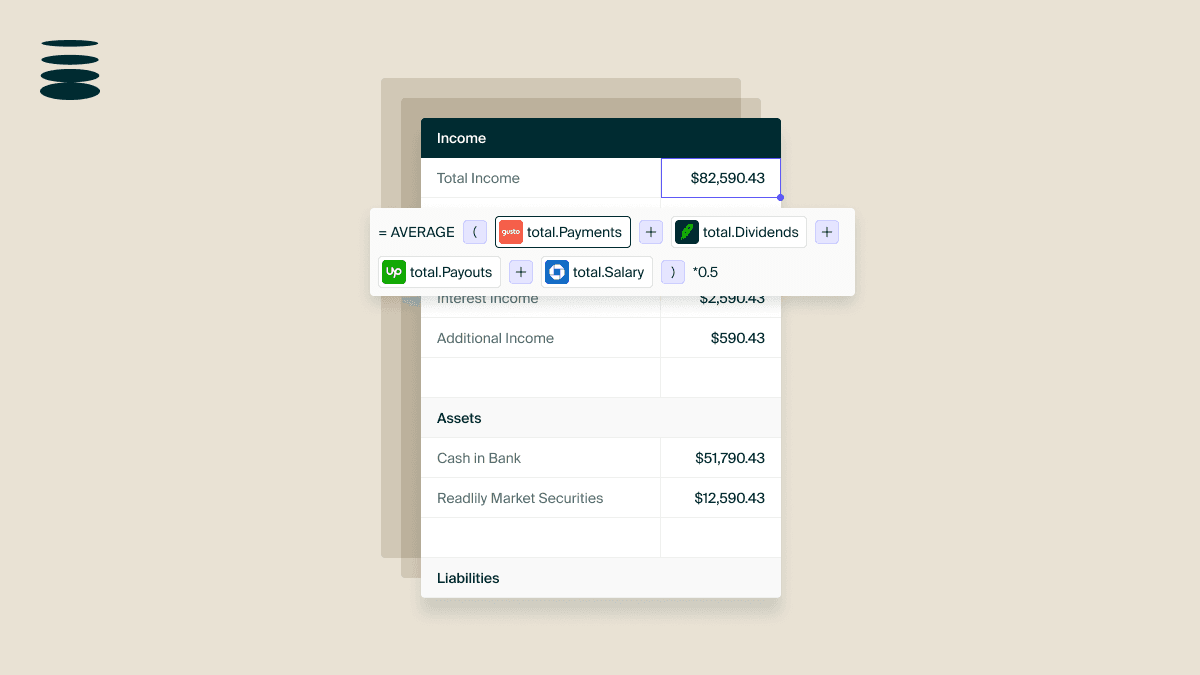

Autonomous reporting refers to the automated creation of borrower financials like P&L Statements, Financial Projections, and Balance Sheets which replace the same self supplied documents used in a credit application.

Within this process, a customer’s financials are:

- Deconstructed to as many raw data points as possible, to be…

- Verified first as a primary traceable source before being…

- Standardized into a shared language of algorithmically calculable signals, to be…

- Reconstructed into a new record of truth that reveals real meaning, trusted at every level.

Data is collected, standardized, and activated for any scoring framework without the need for the routine back and forth between customer and underwriter.

Autonomous reporting removes a layer of redundant data verificiation by forming a database for every person from all of their raw data across as many accounts, documents, and sources permitted. Lenders can query the database with different underwriting calculations, running the relevant data through different frameworks needed to assess by product and creating borrower reports that are formatted and calculated to the lender's standards without the need for borrowers to shoulder the paperwork burden.

With autonomous reporting, the data harnessed for our decisioning algorithms isn't merely abundant but is verified as true at the very start in how it exhibits value, accuracy, and structural soundness – elevating the overall decision-making process into an outcome worth banking on.