—

We refer to traditional credit underwriting as ‘One-Shot’ underwriting because it’s a static assessment of point-in-time creditworthiness that’s only good for the one instance and product.

Underwriting is a historically manual process at many banks that requires a significant lift from

Every time an application comes in, lenders must pull all the documentation to verify, underwrite, and decide

This method often costs banks $100–$400 per underwriting event. Meaning, every time a borrower applies for a financial product underwriting has to begin again with a fresh set of documents, financials, and re-initiates the

The one-shot underwriting process is both expensive for banks and frustrating for customers, making it difficult for banks to offer competitive products while failing to clearly outline the steps a consumer may take to achieve a financial goal or product qualification.

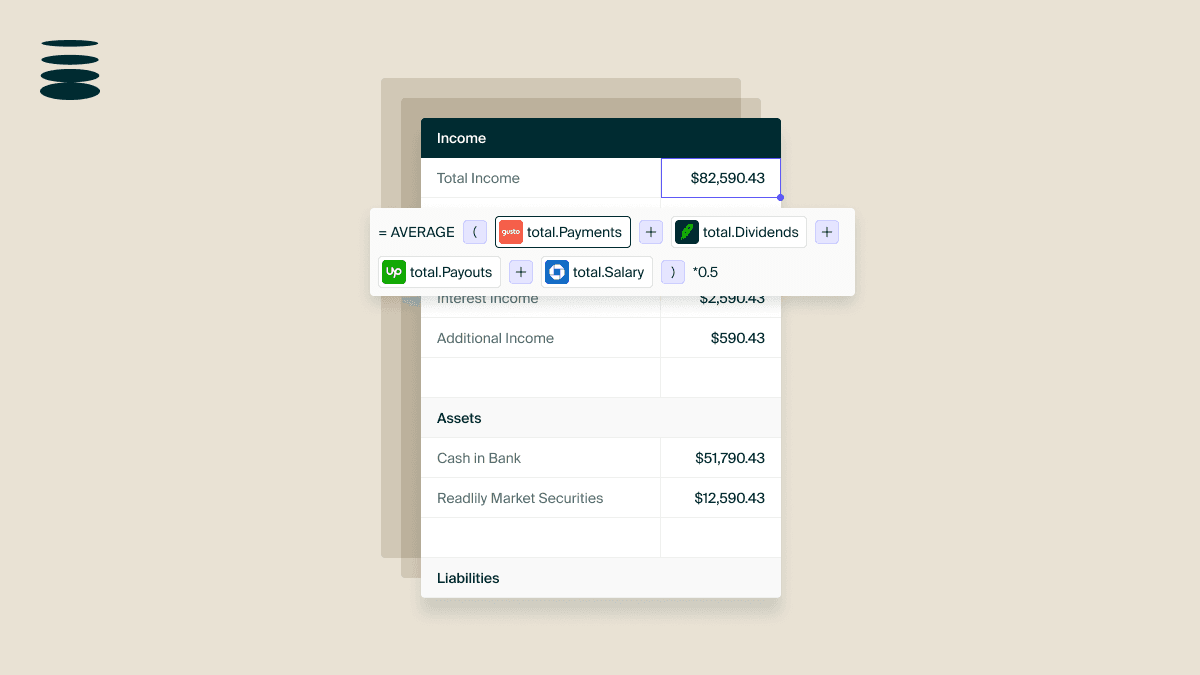

Compare this to continuous underwriting, a method of analyzing a borrowers financials in real time at all times to proactively qualify people for financial services.